COLUMBUS, Ohio – November 5, 2025 – 54% of North American retailers surveyed say they …

The New Role of Stores

In-store shopping is never going out of style. In a world dominated by technology, in-store shopping almost feels primal, like a refreshing shift from the online world that we grew especially accustomed to during the pandemic. The impact of stores must be reimagined. Customers seek a unified shopping experience when they are online and offline.

Consumer Trends

Shoppers gravitate to the in-store experience for ease, speed, and the ability to engage with the items they are considering purchasing. Stores open up the possibility of meeting all of these desires and exceeding expectations.

By integrating technologically-forward shopping modalities with the in-store experience, retailers are able to provide the convenience and flexibility that their shoppers seek. To stay relevant, retailers must adopt the omnichannel features that consumers have come to expect. BOPIS/BORIS (buy online pickup in store, buy online return in store), Endless Aisle, self-checkout, and mobile POS are all examples of shopping experiences that enhance the in-store experience by decreasing friction and increasing customer service.

BOPIS has seen a dramatic increase since the beginning of the pandemic. 2020 BOPIS orders grew by 106.9% over 2019, with forecasts predicting it will continue to grow steadily by 15% annually. Consumers have undoubtedly come to expect smooth BOPIS operations at stores. Lowe’s took BOPIS to the next level by implementing self-service lockers at over 1,700 stores so customers can scan a barcode to expedite their transaction process. Nordstrom launched Nordstrom Local locations, which doesn’t sell merchandise but instead offers services including pickup for online orders. Target’s website allows customers to filter website inventory by what is available for pickup immediately. Kohl’s requires a minimum purchase amount for shipping, whereas BOPIS orders are free and can be fulfilled within an hour. Many retailers designate BOPIS parking spots to prioritize these customers and make online ordering even more appealing.

Endless aisle gives retailers the opportunity to save the sale when an item is out of stock. Out-of-stock scenarios are the catalyst for a shopper purchasing an item from a competitor. According to Digital Commerce 360, upon visiting a store and finding a product they want is out of stock, 17% of U.S. online adults say they would use their mobile devices to make an immediate purchase at a competitor’s website; 37% say they will buy that item from an online retailer when they get home and 35% say they will go to a different store to buy it.

Dismantling the pain point of long lines is the self-checkout revolution. In addition to dispersing lines, self-checkout stations provide dynamic opportunities for retailers to communicate brand messaging through interactive kiosks. According to Forbes, 60% of survey respondents prefer self-checkout over cashier-assisted checkout. The survey shows that consumers are interested in quicker transactions and avoiding face-to-face interaction with associates, especially in response to the pandemic.

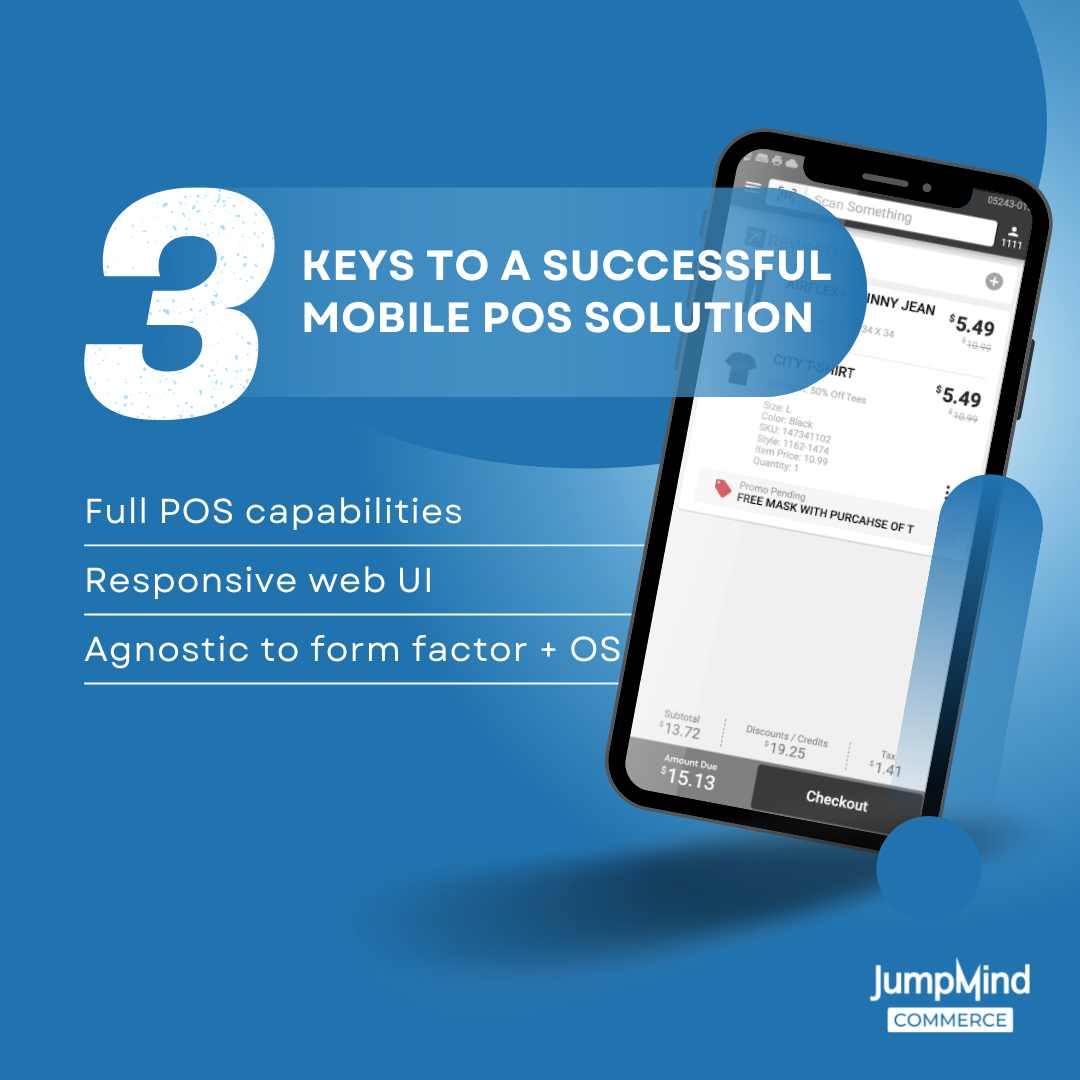

A mobile point of sale, or mPOS, system enables associates to complete transactions from any location in the store using a handheld device. The beauty of a flexible mPOS solution is that it provides customers with an engaging, fast, and seamless experience while they shop. In addition to a customer experience that flows optimally, when retailers go all-in with mPOS, they eliminate the need for fixed cash wraps and can utilize the extra space for selling more merchandise. According to Research and Markets, The Global Mobile POS Device Market size was estimated at $41.43 billion in 2021, $45.33 billion in 2022, and is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.59% to reach $71.78 billion by 2027. One of our retail clients implemented JumpMind Commerce for POS mobility by utilizing iPad stations. Their new POS is flexible and future-proofed with software that can support the evolution occurring in retail. The experience for the associates and customers is simple and intuitive regardless of device time or interaction point.

The Store Experience

With the rise of these technical advancements, customers have raised their standards on what kind of experience they expect when going to a store. As a tactile representation of a brand, a store is a company’s biggest asset. A brick-and-mortar experience allows brands to cultivate a persona that speaks directly to their customers. Retailers that provide distinct, unique experiences are top-of-mind and have a great influence on brand loyalty.

Doing it well will differentiate a brand from competitors in that same vertical. To harness the power of branding, retailers must cultivate a comprehensive identity that plays on emotions and stimulation. Providing a rich culture lures customers into stores. Culture is communicated through aesthetics, sensory environment, and interaction with sales associates.

Emotional triggers and sensory stimuli all play an important role in a consumer’s decision to purchase. By understanding the power of emotions in consumer purchasing decisions, brands have the opportunity to dramatically increase sales at their brick-and-mortars.

For example, Lush raised the bar by providing an immersive in-store experience that allows customers to interact with the products while indulging all of their senses. Sephora and Ulta provide their customers with personalized makeovers, so they can leave feeling beautiful and having tried the products. Lululemon offers free yoga classes to encourage people to visit the store. And, I know I can’t be the only one who gets excited about going to Costco to try all the samples.

Small store formats is a newer trend that has resulted in increased sales and brand recognition for retailers. Companies like Kohls and Macy’s are utilizing smaller store formats to provide accessibility and tailored assortments to different communities. These stores are infusing local flavor into each location that complements the available products to the needs of the consumers. For example, you probably won’t find a parka at the Kohls in Miami. Plus, with a wider network of stores, there is more accessibility to order fulfillment points. This helps retailers keep up the pace for shipments that customers expect.

Smaller store formats can thrive by curating hyper-personalized experiences that go beyond a transaction. Nordstrom is utilizing this concept to connect with shoppers by providing more service-oriented offerings through their smaller store formats known as Nordstrom Local locations. These locations are being utilized for BOPIS/BORIS orders, express alterations, and donation dropoffs, while also providing a children’s play area and a coffee shop.

Immersed in different locations, brands have the opportunity to make an impact in their communities. A retail client of ours has implemented veterinary and grooming services in stores to support company initiatives. Their newest rollout offers mobile services around local communities.

Another new concept has evolved in which retailers join forces to provide fun and effective shopping experiences with stores-in-stores. This is when a retailer sets up shop in a designated area of another retailer’s store. These one-stop shops are providing greater convenience that consumers are in pursuit of. Target and Ulta, Sephora and Kohl’s, Kroger and Bed Bath & Beyond, and more to come are some examples of corporations exploring this approach.

Stores are around for good. To stay relevant, retailers must adjust to consumer demands and provide an enjoyable, engaging store experience.