Retailers are constantly looking for new ways to generate revenue and stay competitive. One strategy …

![]()

Cloud-native POS platform for seamless omnichannel customer experience.

![]()

A single hub for all promotions campaigns.

- Omnichannel ExperienceCreate seamless customer experiences

- Device IndependencePOS agnostic to form factor or operating system

- Self-CheckoutDo more with fewer associates

- Mobile StoreLeverage POS from anywhere

- POS on the GoEnable associates to sell outside of the store

- Unified PromotionsStreamline and simplify promotion workflows

- CX ConnectAllow customers to engage with POS during checkout

- Composable CommerceCreate the store experience you want

![]()

The most advanced synchronization solution for databases and file systems.

![]()

Data configuration and batch automation across different disparate systems and vendors.

-

Data Replication

- Multi-tier DistributionReplicate thousands of remote locations

- Cloud Database ReplicationCapture live changes from on-premise to the cloud

- High Availability and Load BalancingEnsure 24/7 access to data and scale efficiently with demand

- Analytics and ReportingCapture the whole picture with real-time reporting

- Multi-masterMaintain consistency of data in a peer to peer setup

- Data WarehouseReplicate live and historical data to a warehouse

- MigrationsConduct live data migration with no downtime

-

-

Data Integration

- Master Data ManagementChanges propagate across the entire system, allowing you to maintain a centralized view of all parts of your core business entities.

- Application IntegrationReduce dependencies, complexity, and risk to build a high-performance, data-driven application.

- Web ServicesIntegrate multiple systems using web services or build a business application using a service-oriented architecture.

- Data WarehouseIntegrate disparate data from multiple systems so you can transform data for better business intelligence and reporting.

- Data MigrationConduct live data migration during critical server replacements, storage upgrades, and data center relocations—with no downtime.

- ImplementationIntegration consultants help design, develop, and deploy an implementation of our products.

- DevelopmentThe product developers can add features, enhance existing functionality or build support for new platforms.

- TrainingEngage our experienced training resources to gain in-house knowledge and expertise on Jumpmind products.

- SupportLeverage product engineers to resolve issues, fix defects and provide updates or patches.

- Proof of ConceptDetermine the feasibility of implementing our products and get answers to your questions quickly.

Clienteling isn’t a new theory. It can be traced back hundreds of years when shopkeepers …

BOPIS, BORIS, and Curbside Pickup offer consumers and retailers the best of both worlds. …

View all Blog Posts

The SymmetricDS product can synchronize data between over forty different database platforms with out of …

Compare and Repair for SymmetricDS Pro can compare two databases, report on the differences, and …

Mobile replication with Android edge devices in near real time to an on-premise or cloud …

View all Blog Posts

Jumpmind President and CEO Joe Corbin to Lead Panel on Agility at Scale and Digitalizing …

Retail Technology Leader Jumpmind Brings Newfound Interactive and Personalized Digital Engagement to Inspire Shoppers at …

Retail Technology Leader Jumpmind Provides Enhanced Experiential Point of Sale and In-Store Engagement for Build-A-Bear Workshop …

View all Blog Posts

![]()

Cloud-native POS platform for seamless omnichannel customer experience.

![]()

A single hub for all promotions campaigns.

![]()

The most advanced synchronization solution for databases and file systems.

![]()

Data configuration and batch automation across different disparate systems and vendors.

-

Data Replication

-

-

Data Integration

-

Retail Retail trends, technology, and enhancing the customer experience

-

Data Thoughts on data matters, dialects, performance, and security

-

Case Studies How Jumpmind impacts the businesses of our clients

-

Videos & Webinars Watch on demand demos, reviews, and tours of our products

-

Company News Get the scoop on Jumpmind's growth and impact

View all Blog Posts

Back to School 2022

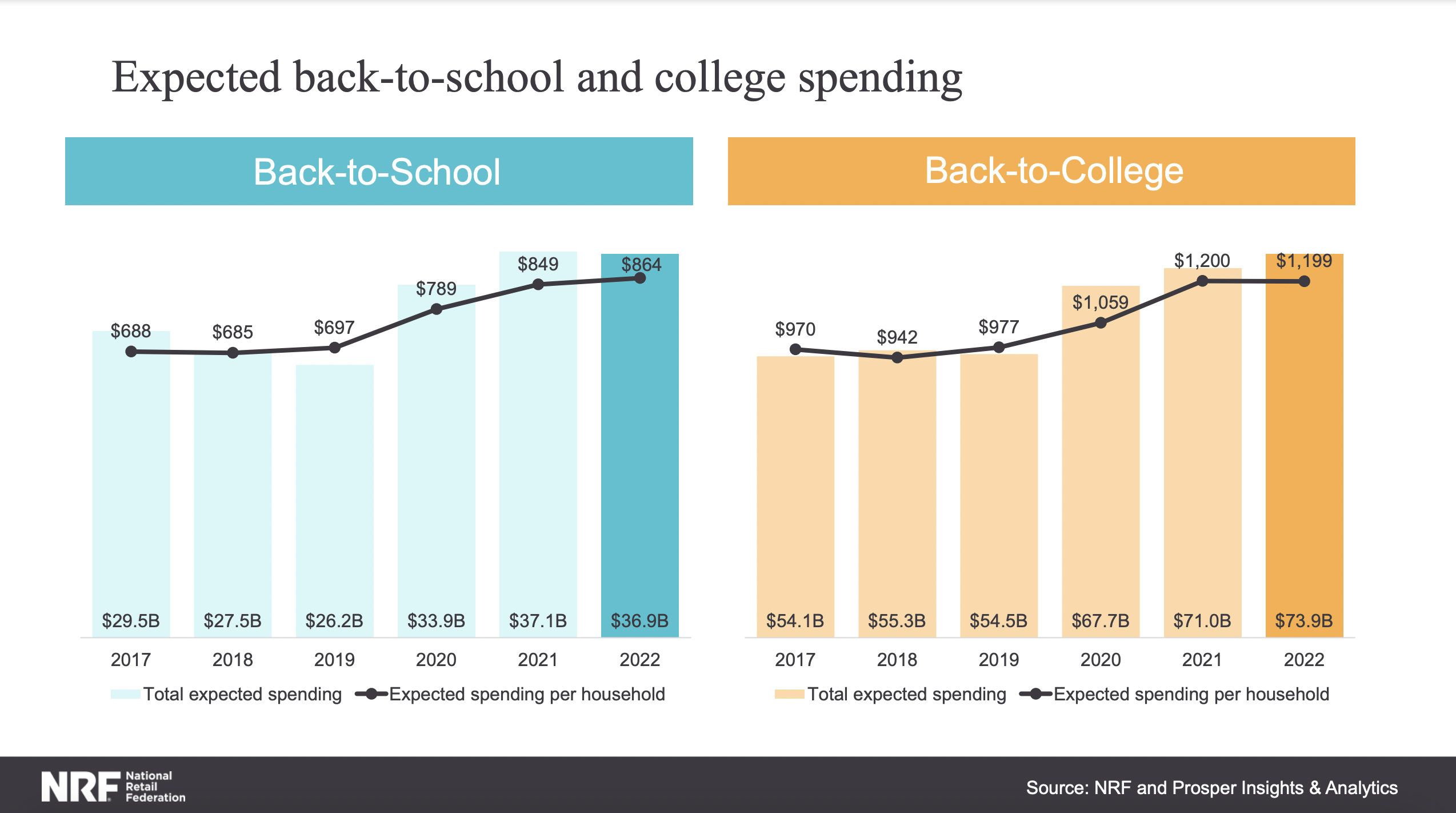

We are almost on the other side of the second biggest spending event of the year, the back-to-school season. With inflation at a record high in over 40 years, 2022 back-to-school spending revenue is going strong. According to the National Retail Federation, revenue is expected to reach $37B on supplies for K-12th grade, with families spending an average of $864. Back-to-college families are spending an average of $1,199, contributing to the total expected spending to reach $74B.

As expected, consumers are changing how they shop in response to inflated prices. 2021 spending experienced record highs as students went back to school after a year of stimulus checks and at-home learning. This year’s shopping behaviors look a lot different from pre-pandemic years, as consumers are more strategic and creative with their spending.

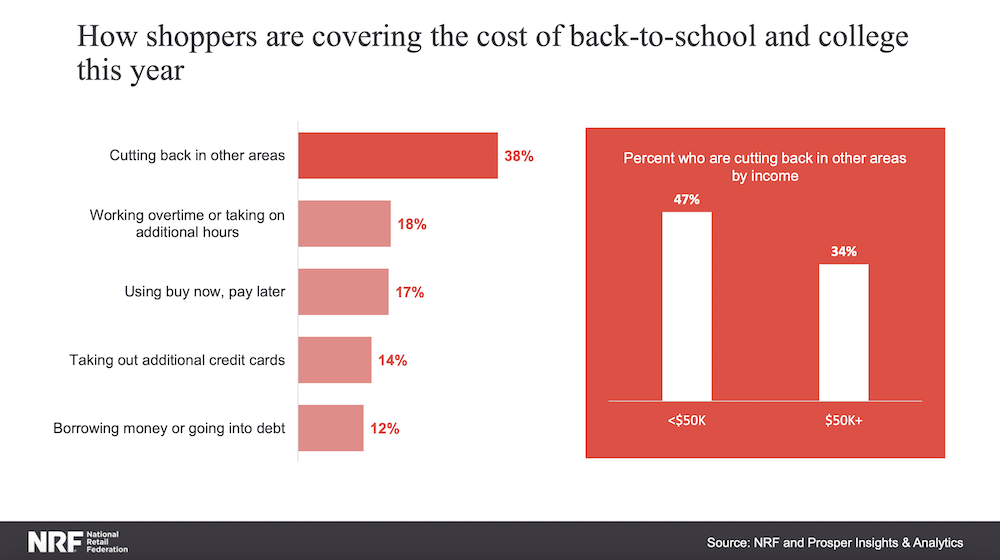

Over a third of consumers surveyed by NRF said they planned to cut back in other categories to compensate for the inflated cost of items needed for the school year. Technology has returned as the top category this year, contributing to 50% of back-to-school spending. Since the onset of the pandemic, it has grown into the core category for back-to-school shoppers. With the high value and essential nature of these items, consumers are prioritizing this category. In addition to saving in other areas, they are covering the cost in ways such as working overtime; using buy now, pay later; taking out additional credit cards; and borrowing money or taking their bank account into the negative.

Other ways we are seeing more and more creative methods for shoppers to ease the blow to their wallets include:

- Adding all the back-to-school essentials to various online shopping carts and comparing prices

- Stretching out the spending season over a longer period of time to take advantage of promotions, prepare for potential product delays and shortages, or simply spread out their budgets

- Engaging in Facebook groups of parents sharing saving tips

- Reducing products with frills such as glossy notebooks or tech with all the bells and whistles

- Holding off on purchasing some items while kids are back at school to ensure that the items are necessary

- Shopping at consignment stores rather than buying new clothes

In light of the hard times that come with inflation, we are seeing that students of all ages are geared up to have a successful school year. In addition, parents are getting creative in attaining and saving on necessary items, with some even building community around it. These shopping behaviors inform the buying patterns that retailers will see in the upcoming holiday season. Methods like comparative shopping while walking around the store on their phones, prioritizing value over brand names, and shopping dispersed across the winter months all indicate that retailers are going to have to be more strategic when the holiday season rolls around.