Retailers are constantly looking for new ways to generate revenue and stay competitive. One strategy …

![]()

Cloud-native POS platform for seamless omnichannel customer experience.

![]()

A single hub for all promotions campaigns.

- Omnichannel ExperienceCreate seamless customer experiences

- Device IndependencePOS agnostic to form factor or operating system

- Self-CheckoutDo more with fewer associates

- Mobile StoreLeverage POS from anywhere

- POS on the GoEnable associates to sell outside of the store

- Unified PromotionsStreamline and simplify promotion workflows

- CX ConnectAllow customers to engage with POS during checkout

- Composable CommerceCreate the store experience you want

![]()

The most advanced synchronization solution for databases and file systems.

![]()

Data configuration and batch automation across different disparate systems and vendors.

-

Data Replication

- Multi-tier DistributionReplicate thousands of remote locations

- Cloud Database ReplicationCapture live changes from on-premise to the cloud

- High Availability and Load BalancingEnsure 24/7 access to data and scale efficiently with demand

- Analytics and ReportingCapture the whole picture with real-time reporting

- Multi-masterMaintain consistency of data in a peer to peer setup

- Data WarehouseReplicate live and historical data to a warehouse

- MigrationsConduct live data migration with no downtime

-

-

Data Integration

- Master Data ManagementChanges propagate across the entire system, allowing you to maintain a centralized view of all parts of your core business entities.

- Application IntegrationReduce dependencies, complexity, and risk to build a high-performance, data-driven application.

- Web ServicesIntegrate multiple systems using web services or build a business application using a service-oriented architecture.

- Data WarehouseIntegrate disparate data from multiple systems so you can transform data for better business intelligence and reporting.

- Data MigrationConduct live data migration during critical server replacements, storage upgrades, and data center relocations—with no downtime.

- ImplementationIntegration consultants help design, develop, and deploy an implementation of our products.

- DevelopmentThe product developers can add features, enhance existing functionality or build support for new platforms.

- TrainingEngage our experienced training resources to gain in-house knowledge and expertise on Jumpmind products.

- SupportLeverage product engineers to resolve issues, fix defects and provide updates or patches.

- Proof of ConceptDetermine the feasibility of implementing our products and get answers to your questions quickly.

Clienteling isn’t a new theory. It can be traced back hundreds of years when shopkeepers …

BOPIS, BORIS, and Curbside Pickup offer consumers and retailers the best of both worlds. …

View all Blog Posts

The SymmetricDS product can synchronize data between over forty different database platforms with out of …

Compare and Repair for SymmetricDS Pro can compare two databases, report on the differences, and …

Mobile replication with Android edge devices in near real time to an on-premise or cloud …

View all Blog Posts

Jumpmind President and CEO Joe Corbin to Lead Panel on Agility at Scale and Digitalizing …

Retail Technology Leader Jumpmind Brings Newfound Interactive and Personalized Digital Engagement to Inspire Shoppers at …

Retail Technology Leader Jumpmind Provides Enhanced Experiential Point of Sale and In-Store Engagement for Build-A-Bear Workshop …

View all Blog Posts

![]()

Cloud-native POS platform for seamless omnichannel customer experience.

![]()

A single hub for all promotions campaigns.

![]()

The most advanced synchronization solution for databases and file systems.

![]()

Data configuration and batch automation across different disparate systems and vendors.

-

Data Replication

-

-

Data Integration

-

Retail Retail trends, technology, and enhancing the customer experience

-

Data Thoughts on data matters, dialects, performance, and security

-

Case Studies How Jumpmind impacts the businesses of our clients

-

Videos & Webinars Watch on demand demos, reviews, and tours of our products

-

Company News Get the scoop on Jumpmind's growth and impact

View all Blog Posts

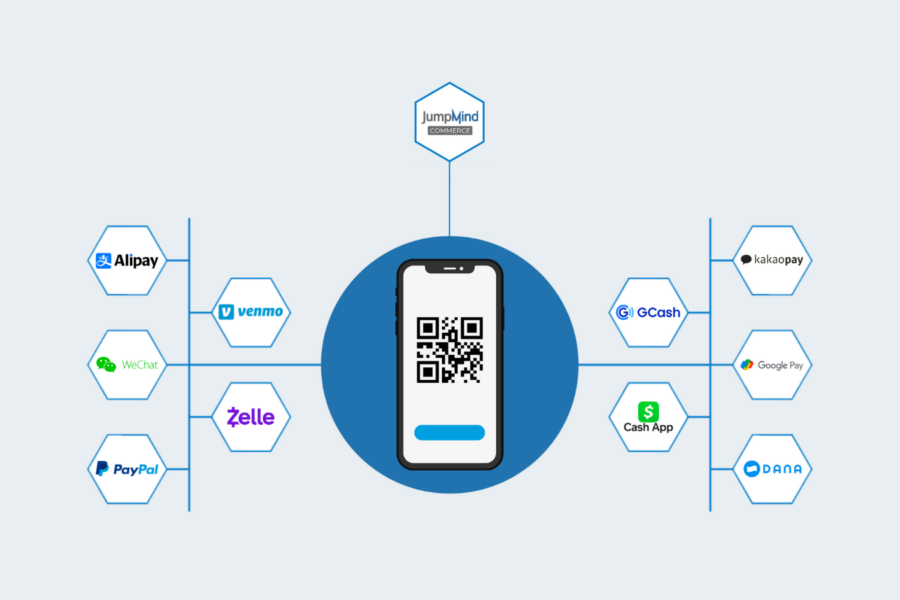

QR Code-Based Payments Reduce Friction at Checkout

Retail shifted during the pandemic and continues to evolve as we all contend with the new normal. This includes new customer journeys like curbside pickup, dark stores that became fulfillment centers, and contactless payment methods. All of these really just accelerated the expectations of consumers. In the 2021 report, The State of the US Shopper, Forrester says 43% of US adults want more stores to support tap-to-pay or contactless payment options. With contactless payments, more and more consumers are leveraging tap-to-pay payments with Apple, Google, or even just a typical credit card along with QR code (QRC) payments through PayPal, Venmo, Cash App, and many, many more.

QRCs have become a preferred payment method for younger generations. These methods provide ease and speed in payment and these consumers often leverage these digital wallets for transferring money between friends and family along with paying for small business services, such as landscaping or AC repair. These payment methods have increased in popularity in North America but have been the most commonly used method in Asian countries. For a retailer, enabling simple acceptance of these payments reduces friction with the tech-savvy Gen-Z and Millennials, as well as travelers from China and other Asian countries where these payment methods are preferred.

When accepting QRC payment, the typical approach is either having the consumer scan a barcode off of a payment entry device or, what’s considered the gold standard globally, where the customer presents the QRC and the retailers scan it. The typical process is:

- The customer is in their favorite QRC payment app such as Venmo

- They click on “pay” and show to pay

- The merchant then scans that secure QRC

- A seamless interaction between the customer and associate occurs

It is really that simple. This method is also very secure. The data transmitted via a QRC is encrypted and used just at that moment.

In JumpMind Commerce, we provide customer-presented QRC-based payments through integration to the global QRC payments leader, Pockyt. Store associates don’t have to consider which QRC wallet provider is being used. No questioning of, “Is this Venmo, WeChat, or AliPay?” They just scan any QRC wallet through JumpMind Commerce and Pockyt manages routing to the appropriate provider. When an associate is on a mobile device, they don’t even need to have a payment device with them, they can use the camera and just scan the QRC directly from the customer’s phone.

As retailers continue the unending search for ways to eliminate friction in stores, QRC payments can provide one of the most streamlined processes to keep up with changing consumer expectations.

Joe Corbin

Joe has been in retail for his entire career and spent the last decade working as a retail software provider. He is passionate about helping retailers solve business challenges and see value in new commerce technologies. When not working, Joe enjoys golfing, boating, and watching his favorite football team.